Introduction

Inflation plays as an essential macroeconomic variable in any economy. Simply, inflation is

known as a continuous increase in the general price level of the economy over some time.

Inflation is determined by the gap between aggregate demand and aggregate supply. For

increase is not a once-and-for-all rise in the price level due to some extraneous circumstance

but a continuous rise due to excessive aggregate demand. (A.D.V.De S.Indraratna) Inflation

reduces the purchasing power of money. Price Stability is one of the core objectives of Central

Bank of Sri Lanka like in many other countries which indicates the degree of criticism of

inflation. Consumer Price Index, Wholesale Price Index, and GDP deflector are used as main

measures of inflation in Sri Lanka. CPI and GDPD are moved and increasing closer together.

Even WPI moves in the same direction, it is more volatile, rising, and falling more quickly.

Since it is a cost of production index which gives higher weight to internationally traded

commodities while the other two are final selling price indices. (Figure 1) There are different

types of inflation such as hyperinflation, galloping inflation, creeping inflation, suppressed,

etc. Foodflation is a new kind of inflation we are experiencing in today implies with global

food prices rising, cost of living has been growing, and this has caused an increase in many food

deficits or food-importing countries including Sri Lanka. This is a kind of cost-push inflation.

(A.D.V.De S.Indraratna, 2009)

Causes of Inflation

Mainly, causes of inflation are Demand-Pull Inflation which means an increase in aggregate

demand more than the available aggregate supply in the economy and Cost-push inflation

which indicates the reduction in the supply of the economy due to a rise in input prices which

will lead to rising in total production cost.

Causes of Inflation in Sri Lankan Economy (From 1977 to up to date)

When considering inflation from 1948 to present, it shows that inflation rate has significantly

increased after introducing open economic policies in 1977 by eradicating trade barriers and

exchange controls. (Figure 2) As well as when compare Sri Lankan inflation with rest of the

world it illustrations that Sri Lanka and emerging market and developing economies have a

high inflation rate since 1980. (Figure 3) It can be analyzed different causes which had make

influences to Sri Lankan economy and have affected to the inflation rate movements of Sri

Lanka during the period 1977 to present which will be mentioned follows.

• Changes in Import and Export Prices

Changes in CCPI & GDPD over most of the post-1978 period appear to be explained mainly

by corresponding changes in import and fiscally induced prices. Further WPI

has changed due to import and export price changes. (H. Nicholas, 1991) With an

increase in the value of exports will lead to an increase in exporter income, which reflects

an increase in demand in the market.

Further as import prices increase mainly non traded

factor prices, there will be a pressure on the domestic price level and will

reduce the value of the local currency. After liberalization UNP government encouraged

Direct Foreign Investment and private sector participation with new policy package

and lead to export-oriented industrialization. Figure 4 shows that CPI moves along

with an import price index. However, in the middle 1983-1986, this relation has collapsed

due to large movements in export prices, changes in administratively determined

prices and a decrease in domestic supply due to drought in 1986. It can be observed a

close relationship between WPI, the Export Price Index, and Import Price Index. (figure 5)

• Internal conflicts

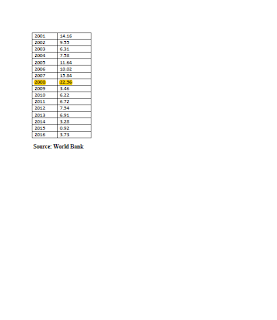

The year 1983 a civil war had started in the country which had till middle 2009. Due to

this 1983-2009 period government spent on a considerable amount of war. Therefore,

inflation during this period had affected by civil war. Further, this shows a higher

inflation rate of 22.56% in the year 2008 with an increase in government spending on

military purposes. With the end in civil war 2009 inflation has reduced to 3.46%.

The country was politically boisterous during the 1988-1989 period due to JVP unrest

which remarked a two-digit inflation rate.

• Depreciation of Rupee Value

In 1977 liberalization period UNP was in power, and a system of the managed float

was adapted to determination of the exchange rate as Sri Lankan Rupee

value depreciated by 46% against US$. Since 1977 to present nearly, there is a

devaluation of rupee value with respect of dollar. This adversely impacts on import

prices which result in an increase in trade deficit since Sri Lanka is highly import

depended on the country. In 2016, around 30% of GDP was imports of goods and services

in Sri Lanka. (CBSL)

• Increase Government Debt

There is an increasing trend in government debt since 1977, which make an upward

inflationary pressure. After 1977 the government has obtained loans to finance major

infrastructure and other government projects like Mahaweli development project and

Public-Private projects like Air Lanka, Hotel Hilton, and Pelawatta Sugar Company,

etc. However, Scholars has mentioned that currently Sri Lanka taking bigger loans to

repay the loan that has already taken and using the loan to finance recurrent

expenditure of the government. Therefore, it was revealed that the country will fall

into a possible debt trap unless the loans taken are used effectively in productive

investment. (Ganeshamoorthy, 2011)

• Increase in the money supply

According to monetarists’ argument, inflation occurs due to continuous expansion in

the money supply of the economy. The constant depreciation of rupee value, an increase

in exports and bank financing of government deficit make a substantial increase in

the money supply. In the year 2008, inflation had laid at a higher rate, and there was an increase

in the money supply. (Heritage money series) Further, there is an increasing trend in the money

supply of Sri Lanka during the period. (Figure 6)

• Increase in government expenditure

In recent years the government had spent significant expenses on civil war. Further, when

considering about government expenditure, Sri Lanka maintains a large government

sector with large no of employees, government institutions and ministries. Hence,

government expenditure is allocated hugely for these expenses. It is questionable

about the efficient and effectiveness of the government sector. Further, government

expenditure in Sri Lanka is more than its revenue by making negative savings.

Since past years the government has adapted primary income transfer for poverty

alleviation program and spent on subsidies.

• Increase in government and private investment

In the years 1978-1998 period, the government had started several costly

infrastructure developments projects. Therefore, it affected to government budget in

a highly expansionary manner. As well as with the end of civil war in the country

government has invested in many infrastructure development projects like Maththala

Airport, Hambantota Harbor, road development project, etc. But the income receive

from these projects is doubtful whether it complies with the amount of money spent.

As well as these investments make an inflationary pressure.

• Natural Disasters

Sri Lanka is faced to mainly frequent natural disasters drought and flood. In 1978,

the mid-1980s, 1983-1986, 1988 period and recently 2016,2017 years production of

the economy had declined due to bad weather condition.

In the year 2003 inflation was 6.31 %. In December 2004 Sri Lanka faced a natural disaster

of Tsunami which leads to increase inflation rate to 7.57% in 2004 and 11.63% in

2005.

• End of civil war in 2009

End of civil war in mid-2009, which was in around three decades has made a

favorable impact on the economy. In 2009 inflation has significantly reduced to 3.46%

which was the lowest inflation recorded after more than two decades, which was

22.56% in 2008. End of civil war encourages government and private investment.

• Global Food Supply and prices

There are some world Supply shortages of agricultural commodities due to crop

failures in major producing countries due to adverse weather conditions, primarily wheat

and milk foods. As well as the diversion of primary farm products such as sugar,

maize, wheat, corn, and edible oil to bio-fuel production due to high oil prices,

whereby creating supply shortages in the world market. The impact of these factors

on inflation has been very severe for countries like Sri Lanka, which heavily depend

on imports for such items. Food prices in Sri Lanka have closely followed FAO

global food price index, which has risen sharply in 2007. (CBSL, 2008) Further, it can

be observed an increasing manner of food prices in Sri Lanka.

• Increase in Population

Increase in population has identified as a cause of inflation due to making an increase

in aggregate demand. The people of Sri Lanka has an increasing trend since 1977.

This is also another cause of inflation in Sri Lanka.

• Other Causes

In 1978-1988 period, with the movement to open economic policies in 1977,

the government changed towards export-oriented industrialization got away from the

previous, adapted Import Substitution Industrialization. It has also allowed reaching

interest rate very high levels to make easy of financing. Most price controls and

quotas were eliminated, and universal food subsidies were replaced by a targeted food

stamp scheme to benefit only the lowest income earners. It has allowed to establish

branches of foreign banks and introduced institutional facilities to encourage trade

and investment. After the expansion of the financial institutions, domestic credit has

increased considerably since the favorable condition to private investors. The policy

change in 1977 worker migration to middle east countries has risen, and due to

an increase in remittances, an inflationary pressure occurs through an increase in domestic

demand. The world oil crisis in late 1978 had affected the local price level. In 1980-

1984 essential food items such as wheat flour, bread prices, public transport fares, and

oil prices have increased. Further, the government public investment programmer, high

government capital expenditure, and high budget deficit affected to the high inflation

and 1980inflation have reached to 26.1%, which was highest after independence. In

1990 rise was 21.5% due to exchange rate depreciation in 1989, the increase in

fertilizer prices, increase in fuel prices, an upward revision of guaranteed paddy

prices. In 1991-1993 period inflation has reduced as favorable weather condition

and contractions monetary policy. In period 1994-1995 inflation remained at a

single digit due to reduction of administrated prices. Increases in world market price

of imports and drought, which has resulted in power cuts and reduction in production

fueled for the double-digit inflation rate in 1996. (W.D. Lakshman, 2000) (figure 7)

Inflation Beyond 2017

Since the 1980s CBSL has been pursuing monetary targeting as its monetary policy

framework to maintain price stability. In 2017 Central Bank has decided to

move towards a flexible inflation targeting framework in the future.