Background of government Debt

There are three ways to finance the fiscal deficit. They are government debt, money creation, and

taxes. Government debt and money creation impact on economic growth adversely.

(Amirthalingam 2013) The fiscal deficit is a chronic problem of Sri Lanka and other developing

countries. [Table 1].The average fiscal deficit was 13.14 percent of GDP from 1977 to

1990. It was 9.3% from 1991 to 2000. But it was 7.7% from 2000 to 2015. (Central Bank

Report) Anyway a high amount of figure, fiscal deficit to GDP ratio is not good for macro-

The economic environment of Sri Lanka, because the fiscal deficit is financed by government debt. It is

a very popular way to finance the fiscal deficit in Sri Lanka. When fiscal deficit increases, it

causes to increase the government debt. If our country tax system is efficient, the fiscal deficit would

have financed from tax revenue. Thereby government debt could have reduced. But tax revenue

to GDP ratio has been decreasing from 1977 to 2013. [Table 1, Graph 1]. The average tax

revenue to GDP ratio was 18% from 1977 to 1984. But it was 17% from 1985 to 1995. Then

it was 16% from 1996 to 2005. But it was 13% from 2006 to 2015(Graph 2). (Central Bank

Report). But Kaldor (1963) argued that a country should impose taxes at 25 – 30 percent of GDP

to achieve economic growth. Kaldor's’ target needs to Sri Lanka to disentangle the debt

trap (Amirthalingam 2013).

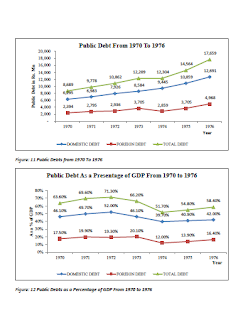

The fluctuation of government debt up to 1977

Government debt has two parts. They are domestic debt and external debt. Household debt is the

debt which borrows from the local market (non- banking or banking or issuing Treasury bill or

Treasury bond) to finance the fiscal deficit. External debt is the debt which borrows from international organizations and foreign countries to finance the fiscal deficit. Domestic debt

surpassed external debt from 1977 to 1986. But external debt had surpassed domestic debt in 1987

To 1996. After that, household debt has exceeded external debt from 1997 to 2016. [Table 3 &

Graph 3]. Anyway, domestic debt and external debt cause their own problems. The obligation to GDP

ratio has reached a peak point in 1989. It was 108.7%. This rate was the highest debt to GDP

ratio in the debt history in Sri Lanka. This had happened because of the deflation of the rupee value

in 1989. When deflating rupee value, it causes to increase the cost of production. Oil and other import

production have to be paid than earlier. It causes to undermine foreign resources, and external debt

services also have to be paid more than earlier. On the other hand, due to the JVP confusion

economy had collapsed in Sri Lanka and the government had to borrow money from the foreign market,

because of domestic savings had undermined during the JVP conflict period. The GDP to external

debt ratio was 62% in 1989. This was the highest foreign debt to GDP ratio in Sri Lanka. As well

as the Mahaweli development project had implemented from 1986 to 1989, therefore, Debt to

GDP ratio had increased by 28.5% from 1986 to 1989. As well as debt to GDP ratio has declined

by 9.5% from 2004 to 2005. The reason behind that was Tsunami disaster. Many of Sri

Lankan’s creditor nations granted debt write off and interest-free periods on loans to assist the

reconstruction process during that period. (Wijeweera, Dollary & Pathaberiya 2005).Debt to

GDP ratio has decreased by 14.6% from 2009 to 2010. The reason was that the war was

finished by 2009. The war which had been three decades in Sri Lanka. (1983-2009).The aim was

behind that government had to borrow a lot of military items to defeat the LTTE. Therefore ending

war caused to decrease the government debt.

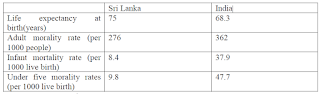

Comparison of Government debt from Asian Countries

When comparing debt to GDP ratio among Asian countries, Sri Lanka has recorded the highest debt

to GDP ratio in 2015. The figure is shown that inability of debt management in Sri Lanka. When

comparing Bangladesh and Sri Lanka. Government debt had been kept sustainable level by

Bangladesh. It was 34% in 2015. But it was 77.6% in Sri Lanka. According to the table

Indonesia, Malaysia, the Philippines, and Thailand had maintained a sustainable level in 2015.Debt to

GDP ratio was 67.2% in India, but it was reasonable they had achieved 8% GDP growth rate in

2015. But the GDP growth rate was 4.8% in Sri Lanka [Table 4]. Therefore the government should keep

GDP to debt ratio as below the threshold level. Research has concluded that the threshold level

for public debt is 59.42% of GDP. Above this level, public debt makes a negative impact on

GDP per capita growth (Cooray & Heemantha, 2013).

Composition of Domestic debt and External debt

Domestic debt has two parts as banks and non -bank sector. As well as external debt has two

parts. They are concessional loan and commercial loan. At the same time, the government can

borrow from banks or non- banks or can get a business loan or concessional loan. .Government

has borrowed debt from the non-banking sector than debt from the banking sector during 1985to2016

(Graph 4). Government has acquired concessional loan than commercial loan during 1980 to

2016. (Graph 5) But the commercial loan has been increasing from 2008 to 2016. The reason was

previous government had issued Treasury bill for foreign investors, and they had invested heavily

in Treasury bond. Second sovereign bond had released in 2009. After graduating from a lower-middle-income country, it made difficulties to borrow concessional loan (Amirthalingam 2012).

Government debt can be defined broadly and narrowly. But the debt to GDP ratio sets using

a narrow definition (Central Bank Reports). Total central government debt is called a narrow

definition of government debt. It doesn’t include contingent liabilities. A contingent liability is

a liability which government entities borrow from the market with the guaranteed issued by the

government. If government entities will not be able to pay off debt, the central government has to take

responsibility of government entity borrowings. They are Ceylon Electricity Board, Ceylon

Petroleum Corporation, Road Development Authority and Sri Lankan Airlines. The narrow

definition misleading since it does not show the actual indebtedness for which the tax players are

responsible. Therefore both of direct borrowings and contingent liabilities should take to the debt

management process.

Consequences of domestic debt and external debt

Household debt and foreign debt cause an economic problem. When the government borrows money lot

from the local market, it causes to increase the interest rate. Thereby impede the private sector

investment. This is called crowding out effect. When decreasing private sector investment, it

impacts on economic growth adversely. Increase in government borrowing may also cause

inflation through the expansion of the money supply. External debt causes to undermine the creditworthiness in Sri Lanka. Foreign currencies should be demanded when paying off international debt

services. This procedure causes to deflate the rupee value. Deflate the rupee value causes to

wane the balance of payment (BOP).

On the other hand, deflating the rupee value causes to

increase the competitiveness of export items. But our export items less than import items and

export items don’t have the strength to earn a lot. That’s why in such a situation, BOP is going to

undermine. Debt service payments are a severe financial burden to the Sri Lankan economy. Debt

repayments as a percentage of revenue have increased from 1980 to 2016. It was 98% in 2016.

Debt repayments as a percentage of exports also have increased from 1980 to 2016. It was 92%

In 2016 (Table 06). Therefore debt service payment compels a country to abandon or postpone

investment on essential development projects. Government expenditures are (Education,

Health) necessary to develop the country. As an example, before developing Singapore

had expended a lot to education. Therefore human capital development is significant to

develop the country. But the Sri Lankan situation is unfortunate. Government has to spend to interest

payment than education expenditure. This is the opportunity cost of debt servicing. In 2015

Interest payment was 22%from total expenditure. But education & welfare expenditure were

10%, Health expenditure was 8% (Table 06). Therefore the government was unable to spend

sufficiently on most important sectors which are very useful to develop the country.

Finally, I suggest procedures to reduce government debt. Fiscal deficit should finance by

tax revenues. Then the tax system should be simple, and politicians should not intervene in the tax

system what businessman evade the taxes. On the other hand, after 2005 there are lots of

corruptions and frauds had recorded. These kinds of crimes also caused to increase the

government debt. As an example, the southern high way project also has recorded corruptions. Then

debt was not enough to implement a plan, and the government had to borrow debt back to finance

the project. Therefore if we want to strengthen as a nation, we should stop corruption and

inefficient things. As well as the government would earn sufficient revenue from exports, the fiscal

deficit could have financed by export revenue, and it will cause to increase the foreign assets in

Sri Lanka. Anyway, the present government has been implementing some strategies to improve tax

compliance. Ultimately they aim to reduce the government debt. Plans are (a) “broadening

the tax base to ensure tax revenue of around 15-16 percent of GDP (b) rationalizing the tax

system while minimizing tax exemptions, tax holidays and special tax rate that are detrimental to

fair and effective tax administration (c) strengthening public financial management, particularly

commitment control and financial planning and discipline (d) eliminating unproductive

expenditure (e) Improving efficiency of State-Owned Business Enterprises.” Restructuring

process, increasing transparency of money transaction and increasing accountability are used to

increase the efficiency of State-Owned Business Enterprises. (Central Bank Report 2016).

There are three ways to finance the fiscal deficit. They are government debt, money creation, and

taxes. Government debt and money creation impact on economic growth adversely.

(Amirthalingam 2013) The fiscal deficit is a chronic problem of Sri Lanka and other developing

countries. [Table 1].The average fiscal deficit was 13.14 percent of GDP from 1977 to

1990. It was 9.3% from 1991 to 2000. But it was 7.7% from 2000 to 2015. (Central Bank

Report) Anyway a high amount of figure, fiscal deficit to GDP ratio is not good for macro-

The economic environment of Sri Lanka, because the fiscal deficit is financed by government debt. It is

a very popular way to finance the fiscal deficit in Sri Lanka. When fiscal deficit increases, it

causes to increase the government debt. If our country tax system is efficient, the fiscal deficit would

have financed from tax revenue. Thereby government debt could have reduced. But tax revenue

to GDP ratio has been decreasing from 1977 to 2013. [Table 1, Graph 1]. The average tax

revenue to GDP ratio was 18% from 1977 to 1984. But it was 17% from 1985 to 1995. Then

it was 16% from 1996 to 2005. But it was 13% from 2006 to 2015(Graph 2). (Central Bank

Report). But Kaldor (1963) argued that a country should impose taxes at 25 – 30 percent of GDP

to achieve economic growth. Kaldor's’ target needs to Sri Lanka to disentangle the debt

trap (Amirthalingam 2013).

The fluctuation of government debt up to 1977

Government debt has two parts. They are domestic debt and external debt. Household debt is the

debt which borrows from the local market (non- banking or banking or issuing Treasury bill or

Treasury bond) to finance the fiscal deficit. External debt is the debt which borrows from international organizations and foreign countries to finance the fiscal deficit. Domestic debt

surpassed external debt from 1977 to 1986. But external debt had surpassed domestic debt in 1987

To 1996. After that, household debt has exceeded external debt from 1997 to 2016. [Table 3 &

Graph 3]. Anyway, domestic debt and external debt cause their own problems. The obligation to GDP

ratio has reached a peak point in 1989. It was 108.7%. This rate was the highest debt to GDP

ratio in the debt history in Sri Lanka. This had happened because of the deflation of the rupee value

in 1989. When deflating rupee value, it causes to increase the cost of production. Oil and other import

production have to be paid than earlier. It causes to undermine foreign resources, and external debt

services also have to be paid more than earlier. On the other hand, due to the JVP confusion

economy had collapsed in Sri Lanka and the government had to borrow money from the foreign market,

because of domestic savings had undermined during the JVP conflict period. The GDP to external

debt ratio was 62% in 1989. This was the highest foreign debt to GDP ratio in Sri Lanka. As well

as the Mahaweli development project had implemented from 1986 to 1989, therefore, Debt to

GDP ratio had increased by 28.5% from 1986 to 1989. As well as debt to GDP ratio has declined

by 9.5% from 2004 to 2005. The reason behind that was Tsunami disaster. Many of Sri

Lankan’s creditor nations granted debt write off and interest-free periods on loans to assist the

reconstruction process during that period. (Wijeweera, Dollary & Pathaberiya 2005).Debt to

GDP ratio has decreased by 14.6% from 2009 to 2010. The reason was that the war was

finished by 2009. The war which had been three decades in Sri Lanka. (1983-2009).The aim was

behind that government had to borrow a lot of military items to defeat the LTTE. Therefore ending

war caused to decrease the government debt.

Comparison of Government debt from Asian Countries

When comparing debt to GDP ratio among Asian countries, Sri Lanka has recorded the highest debt

to GDP ratio in 2015. The figure is shown that inability of debt management in Sri Lanka. When

comparing Bangladesh and Sri Lanka. Government debt had been kept sustainable level by

Bangladesh. It was 34% in 2015. But it was 77.6% in Sri Lanka. According to the table

Indonesia, Malaysia, the Philippines, and Thailand had maintained a sustainable level in 2015.Debt to

GDP ratio was 67.2% in India, but it was reasonable they had achieved 8% GDP growth rate in

2015. But the GDP growth rate was 4.8% in Sri Lanka [Table 4]. Therefore the government should keep

GDP to debt ratio as below the threshold level. Research has concluded that the threshold level

for public debt is 59.42% of GDP. Above this level, public debt makes a negative impact on

GDP per capita growth (Cooray & Heemantha, 2013).

Composition of Domestic debt and External debt

Domestic debt has two parts as banks and non -bank sector. As well as external debt has two

parts. They are concessional loan and commercial loan. At the same time, the government can

borrow from banks or non- banks or can get a business loan or concessional loan. .Government

has borrowed debt from the non-banking sector than debt from the banking sector during 1985to2016

(Graph 4). Government has acquired concessional loan than commercial loan during 1980 to

2016. (Graph 5) But the commercial loan has been increasing from 2008 to 2016. The reason was

previous government had issued Treasury bill for foreign investors, and they had invested heavily

in Treasury bond. Second sovereign bond had released in 2009. After graduating from a lower-middle-income country, it made difficulties to borrow concessional loan (Amirthalingam 2012).

Government debt can be defined broadly and narrowly. But the debt to GDP ratio sets using

a narrow definition (Central Bank Reports). Total central government debt is called a narrow

definition of government debt. It doesn’t include contingent liabilities. A contingent liability is

a liability which government entities borrow from the market with the guaranteed issued by the

government. If government entities will not be able to pay off debt, the central government has to take

responsibility of government entity borrowings. They are Ceylon Electricity Board, Ceylon

Petroleum Corporation, Road Development Authority and Sri Lankan Airlines. The narrow

definition misleading since it does not show the actual indebtedness for which the tax players are

responsible. Therefore both of direct borrowings and contingent liabilities should take to the debt

management process.

Consequences of domestic debt and external debt

Household debt and foreign debt cause an economic problem. When the government borrows money lot

from the local market, it causes to increase the interest rate. Thereby impede the private sector

investment. This is called crowding out effect. When decreasing private sector investment, it

impacts on economic growth adversely. Increase in government borrowing may also cause

inflation through the expansion of the money supply. External debt causes to undermine the creditworthiness in Sri Lanka. Foreign currencies should be demanded when paying off international debt

services. This procedure causes to deflate the rupee value. Deflate the rupee value causes to

wane the balance of payment (BOP).

On the other hand, deflating the rupee value causes to

increase the competitiveness of export items. But our export items less than import items and

export items don’t have the strength to earn a lot. That’s why in such a situation, BOP is going to

undermine. Debt service payments are a severe financial burden to the Sri Lankan economy. Debt

repayments as a percentage of revenue have increased from 1980 to 2016. It was 98% in 2016.

Debt repayments as a percentage of exports also have increased from 1980 to 2016. It was 92%

In 2016 (Table 06). Therefore debt service payment compels a country to abandon or postpone

investment on essential development projects. Government expenditures are (Education,

Health) necessary to develop the country. As an example, before developing Singapore

had expended a lot to education. Therefore human capital development is significant to

develop the country. But the Sri Lankan situation is unfortunate. Government has to spend to interest

payment than education expenditure. This is the opportunity cost of debt servicing. In 2015

Interest payment was 22%from total expenditure. But education & welfare expenditure were

10%, Health expenditure was 8% (Table 06). Therefore the government was unable to spend

sufficiently on most important sectors which are very useful to develop the country.

Finally, I suggest procedures to reduce government debt. Fiscal deficit should finance by

tax revenues. Then the tax system should be simple, and politicians should not intervene in the tax

system what businessman evade the taxes. On the other hand, after 2005 there are lots of

corruptions and frauds had recorded. These kinds of crimes also caused to increase the

government debt. As an example, the southern high way project also has recorded corruptions. Then

debt was not enough to implement a plan, and the government had to borrow debt back to finance

the project. Therefore if we want to strengthen as a nation, we should stop corruption and

inefficient things. As well as the government would earn sufficient revenue from exports, the fiscal

deficit could have financed by export revenue, and it will cause to increase the foreign assets in

Sri Lanka. Anyway, the present government has been implementing some strategies to improve tax

compliance. Ultimately they aim to reduce the government debt. Plans are (a) “broadening

the tax base to ensure tax revenue of around 15-16 percent of GDP (b) rationalizing the tax

system while minimizing tax exemptions, tax holidays and special tax rate that are detrimental to

fair and effective tax administration (c) strengthening public financial management, particularly

commitment control and financial planning and discipline (d) eliminating unproductive

expenditure (e) Improving efficiency of State-Owned Business Enterprises.” Restructuring

process, increasing transparency of money transaction and increasing accountability are used to

increase the efficiency of State-Owned Business Enterprises. (Central Bank Report 2016).