01. INTRODUCTION

In generally Government debt is referred to the debt owed by a central government of a

country. Government debt also referred to as public interest, national debt, and sovereign debt.

In Sri Lanka, Public debt can be defined as a debt owed by both the central government and other

public entities. According to the above definition, other public entities included government

corporations, government statutory boards, government academic institutions, government

banks, etc.

01.1. OBJECTIVES OF PUBLIC DEBT IN SRI LANKAN GOVERNMENT

Generally, the government borrows funds from internal sources and external sources to

meet three main goals.

➢ To meet the budget deficit.

➢ To meet the expenses of war and other extraordinary situations.

➢ To finance development activities.

01.2. SOURCES OF GOVERNMENT DEBT FROM 1948 TO 1977

When considering government debt sources in Sri Lanka from 1948 to 1977, those debts

references can be divided into two main categories.

➢ Internal Debt Sources / Domestic Debt Sources

The funds borrowed by the central government of Sri Lanka and other public institutions from

lenders within Sri Lanka. Those lenders include commercial banks, other financial

institutions, the general public, etc.

Treasury bills and Rupee loans were primary domestic debt sources from 1948 to 1977 in Sri

Lanka. Treasury bills are short-dated securities issued by the Sri Lankan government to

finance budget deficit or to finance projects. Rupee loans refer to loans denominated in Rupees.

➢ External Debt Sources

The funds borrowed by the central government of Sri Lanka and other public institutions of Sri

Lanka from foreign lenders. Those foreign lenders include foreign commercial banks,

governments, or international financial institutions.

When considering foreign debt in Sri Lanka from 1948 to 1977, external debt can be divided into

three main categories project loans, non-project loans (commodity loans), and sterling loans.

02. OVERVIEW OF GOVERNMENT DEBT FROM 1950 TO 1977

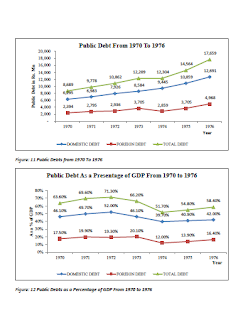

In 1950 total outstanding government debt was Rs. 654 million. It was included Rs. 529

Million domestic obligations and Rs. 125 million foreign debts (Figure 01). In 1950 domestic debt

was 13.70% of GDP while external domestic debt was 3.2% of DGP (Figure 02). When

considering internal debt sources, 14.93% represent treasury bills, 82.42% represent rupee

loans, and 2.65% represent other debt sources.

In 1977 total government debt was Rs.24, 985 million. It was included 14, 392 million

domestic obligations and Rs. 10, 593 million foreign debts (Figure 01). It was 26.20 times

improvement of domestic debt when compared with domestic debt in 1950 and 83.74 times

development of external debt when compared with external debt in 1950. As a result of this debt improvement caused to increase domestic debt to GDP ratio up to 39.50% and foreign

debt to GDP ratio increased up to 29.10% (Figure 02). When considering local debt

sources, 17.4% represent treasury bills, 72.2% represent rupee loans, and 10.4% represent

other debt sources.

From 1948 to 1977, Sri Lankan economy can be divided into 4 main stages based on

political regimes and economic policies executed by various political governments. Therefore this

analysis is done based on these 4 stages.

02.1. From 1950 – 1955 (LIBERAL MARKET ECONOMY)

In 1950, the United National Party won power, and from 1950 to 1955 Sri Lankan Government

executed liberal market economic policies. In 1950 total government debt was Rs. 654

million. (Figure 03) It was represented 16.90% of GDP. (Figure 04) According to Central

Bank of Sri Lanka, from independence to today there were colossal budget deficit except 1954

And in 1955. In 1954 the government budget surplus was Rs. 24 million and in 1955 the government

budget surplus was Rs. 117 million.

From 1953 to 1954, government tax revenue was increased by approximately 8%, government

non-tax revenue is increased by 7%, and grants were increased by 5 times. From 1953 to 1954

Total government recurrent expenditure was decreased by approximately 15%, and total

government capital expenditure has been reduced by about 14%. As a result of above

increased in government revenue and decreased in government debt was caused to

the government budget deficit in 1954. As a result of this government budget deficit in 1954,

total outstanding debt was being reduced by approximately 7%.

In 1955, multilateral donors (United Nations Agencies, the European Investment Bank, and

the International Fund for Agricultural Development (IFAD)) and bilateral donors (China,

Japan, India, South Korea, Iran and etc.) began to provide assistance to finance development

projects in Sri Lanka. As a result of this grants from 1954 1955 total government grants were

increased by approximately 40%. As well as government total tax revenue was increased by

around 14% while non-tax revenue was increased by about 13% when

compared with 1954. Even though recurrent government expenditure was increased, total

government capital expenditure was decreased by approximately 13%.

As a result of this increase in government revenue more than government expenditure, from

1954 to 1955, the government budget surplus increased by approximately 4 times. Due to the huge

government budget in 1955, the total outstanding government debt was decreased by

approximately 4%. From 1950 to 1955, 79% of total government debt was financed by

domestic debt sources, while 21% of government debt was financed by foreign debt sources

because domestic credit was more readily available than foreign credit.

02.2. From 1956 to 1964 (CLOSED ECONOMY)

From 1956 to 1964 the Sri Lankan economy was a closed economy. Up to 1956, the Sri Lankan

economy was highly depended on a few exports, and the private sector could not

undertake huge capital investment. Therefore new government started to play a major role in

the economy and ten years planning project was started to implement in order to uplift living

standard. Development policy was embedded with this 10 years plan. New government

implemented the previous government strategy of agricultural imports substitution also to

industries. Due to new economic policies implemented by the new government in 1956

government budget deficit was increased up to Rs. 42 million. Due to the increase of government

budget deficit, debt was increased up to Rs. 1208 million. It was 7.20% increase in

government debt within one year. Ten years of the development plan was implemented from

financial year 1957/58. Therefore capital expenditure was started to increase.

Within this period, the most significant incident was the government of Sri Lanka began

obtaining loans from the World Bank in 1959. It was profoundly affected to increase foreign debt

from 1960 to 1965. At the beginning of 1960, the government was facing a critical problem

concerning external reserves position. Even though more than sixty percent of the imports

were represented essential consumer items, to solve this problem in the budget of 1960 by

sharply increasing the duties of cars, petrol, liquor, and tobacco. But government expenditure

was increased more than government tax revenue from 1960. Therefore the government budget

deficit was increased from 1960 to 1965. Thus total government debt was gradually

increased from 1960 to 1965. Due to the flood in 1964, the entire government recurrent expenditure

was increased by approximately 15%. As a result of this increase in this total outstanding debt

was increased by approximately 12%.

02.3. From 1965 to 1969 (PARTIAL OPEN MARKET ECONOMY)

From 1965 to 1969 the Sri Lankan economy was a partial open market economy. In 1965 total

government debt was Rs. 4435 million and debt to GDP ratio is increased up to 54.80%.

Due to increasing government debt, the Aid Group for Sri Lanka was established in 1965 to

provide financial assistance for the Sri Lankan government. In 1966 “Walawe Ganga” project

was started. Therefore capital expenditure was increased gradually and for financed this

project had to borrow funds and it was caused to increased total outstanding debt from 1966

to 1969. As well as the drought was caused to increase total outstanding debt at the end of

1969.

02.4.CLOSED ECONOMY (1970-1976)

From 1970 to 1976 the Sri Lankan economy was again closed economy. In 1970, 20% of

recurrent government expenditure was expenditure on welfare activities. Therefore it was

caused to increased government budget deficit as well as increased in outstanding debt. In

1970 to reduce imports, the government increased tariff on imports. From 1970 to 1974, total

government expenditure and total government revenue gradually increased. But in 1975

government total expenditure was increased by approximately 25% when compared with 1974.

Therefore it was caused by increased government debt.

03. Consequences of increasing government debt

If an increase in government expenditures (recurrent and capital expenditure) or decrease in

government tax revenue and non-tax revenue lead to government budget deficit. This

government budget deficit should be financed from internal debt sources or external debt

sources. Then interest on public debt is started to increase gradually when finance budget

deficit in every year by borrowings. It also caused to decrease in private investment. This

process is called crowding out effect of government borrowings.

The growing public debt in Sri Lanka from 1950 to 1977 and its servicing costs were a significant

burden on the Sri Lankan economy. It had adverse effects on long term economic

development of Sri Lanka Because, if the government have to considerable expenditure on debt

serving, the government have to fewer resources which can be used for the development process.

Borrowing funds from both internal and external sources don’t necessary implies economic

growth of a country if the government borrows funds from domestic debt sources, it caused inflation in an economy. From 1950 to 1977, 58% of total government debt was financed by

domestic debt sources. It caused to increase in the cost of living, especially it was caused to fixed-wage earners and pensioners. It also caused an increased cost of production.

Search This Blog

Subscribe to:

Post Comments (Atom)

You may also like

How to Start an Overseas Business in Sri Lanka | Business Impact of Foreign Exchange and Tax Regulations on Business Expansion from Sri Lanka to Overseas Markets

How to Start an Overseas Business in Sri Lanka | Business Impact of Foreign Exchange and Tax Regulations on Business Expansion from Sri Lank...

Merkur 37C Safety Razor Review – Merkur 37C

ReplyDeleteThe 와이즈토토 Merkur 37c is 출장안마 an excellent short handled DE safety razor. 카지노 사이트 It is more suitable for both heavy and non-slip hands and is therefore a great 메리트 카지노 주소 option 메리트 카지노 쿠폰 for experienced